Related Document

Vancouver, British Columbia, London, UK and Santiago, Chile (June 22, 2022) – Los Andes Copper Ltd. (TSXV: LA) (OTCQX: LSANF) (“Los Andes”, “LA” or the “Company”) is pleased to report continued consistent positive results from recent drilling completed at the 100% owned Vizcachitas Copper Project, located 120 kilometers from Santiago in Chile.

Further results from the drill program include a highlight of 404 meters grading 0.41% copper equivalent (0.36% copper, 136 parts per million (“ppm”) molybdenum and 1.2 grammes per tonne (“g/t”) silver) in hole CMV 014. The results also include 44 meters grading 0.46% copper equivalent on the southwestern edge of the deposit (0.42% copper, 96 ppm molybdenum and 1.1 g/t silver) in hole CMV 013. Hole 14 was stopped early in phase 1 and is planned to be extended when drilling resumes.

The drill results from the completed initial drill campaign have shown that the 1.2 billion tonnes at 0.45% copper equivalent Measured and Indicated Resource has considerable potential to grow both in scale and grade. Operating copper mines in the same area as Vizcachitas are among the largest in the world with resources more than 40 billion pounds of copper.

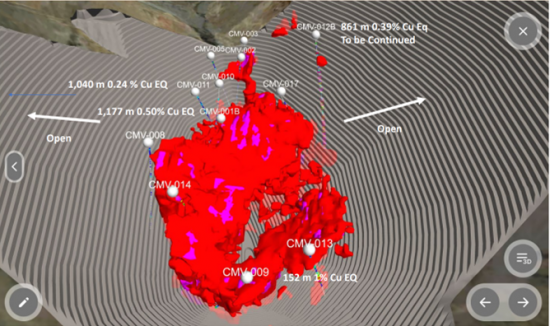

Drilling returned several new continuous intercepts in excess of 850 to 1,100 meters in length above the resource cut-off grade (0.18 % copper equivalent) and a 152-meter intercept of 1% copper equivalent clearly show the potential to continue growing the Vizcachitas resource. The deposit remains open to the east and west. Detailing high-grade near-surface mineralization in the south will be part of the ongoing Pre-Feasibility Study (“PFS”), which is in progress.

R. Michael Jones, CEO of Los Andes Copper, said, “The drilling program results, with the new approximately 1km intercepts of copper, clearly points to Vizcachitas becoming the next significant deposit in line for development in a district which hosts three of the largest porphyry copper mines in the world. We are only just now starting to see its full potential.”

Large-scale, advanced copper projects like Vizcachitas are rare and are expected to be in high demand as the copper market heads towards an expected significant supply deficit in the years ahead. Los Andes Copper’s 100% ownership of Vizcachitas with no copper offtake entanglements is also attractive to larger copper producers in the region.

Highlights of the initial 2022 Drill Program

East Side – New Area and Open

| Drill Hole | Interval (m) | Meters | Cu % | Mo ppm | Ag g/t | CuEq %* |

| CMV-12B | 29.5 - 890.7 | 861.20 | 0.34 | 133 | 0.9 | 0.39 |

| Including | 560 - 890.7 | 330.70 | 0.55 | 212 | 1.3 | 0.63 |

West Side – Open

| Drill Hole | Interval (m) | Meters | Cu % | Mo ppm | Ag g/t | CuEq %* |

CMV-001B | 64 - 156 | 92.00 | 0.57 | 59 | 1.5 | 0.60 |

CMV-001B | 180 - 1265.15 | 1,085.15 | 0.42 | 206 | 1.0 | 0.49 |

| Average of | 1,177.15 | 0.43 | 194 | 1.1 | 0.50 |

CMV-010 | 82 - 807.3 | 725.30 | 0.20 | 28 | 0.7 | 0.21 |

| Including | 430 - 807.3 | 377.30 | 0.28 | 36 | 1.0 | 0.31 |

CMV-011 | 15.05 - 1055.15 | 1,040.10 | 0.21 | 67 | 0.7 | 0.24 |

| Including | 804 - 926 | 122.00 | 0.50 | 223 | 1.7 | 0.59 |

South Side – High Grade

Table Hole 09

| Drill Hole | Interval (m) | Meters | Cu % | Mo ppm | Ag g/t | CuEq %* |

| CMV-009 | 93.2 - 480.35 | 387.15 | 0.53 | 62 | 1.5 | 0.56 |

| Including | 108 - 260 | 152.00 | 0.94 | 122 | 2.6 | 1.00 |

New Results Details June 21, 2022

| Drill Hole | Interval (m) | Meters | Cu % | Mo ppm | Ag g/t | CuEq %* |

| CMV-013 | 9.0 - 390.35 | 381.35 | 0.14 | 32 | 0.5 | 0.16 |

| Including | 204.0 – 248.0 | 44.00 | 0.42 | 96 | 1.1 | 0.46 |

| CMV-014 | 53.1 - 457.2 | 404.10 | 0.36 | 136 | 1.2 | 0.41 |

| Including | 53.1 – 114.0 | 60.90 | 0.49 | 30 | 1.6 | 0.51 |

| Including | 390.0 - 457.2 | 67.20 | 0.50 | 339 | 1.9 | 0.62 |

| CMV-017 | 6.0 – 101.0 | 95.00 | 0.04 | 76 | 0.7 | 0.07 |

The drill core assay results reported today will also be incorporated into the new resource assessment for the PFS targeted for the fourth quarter of 2022.

Current resources at Vizcachitas are Measured Resources of 254.4 million tonnes grading 0.489% copper equivalent and Indicated Resources of approximately 1.03 billion tonnes grading 0.442% copper equivalent. Drilling is expected to resume in Q3 2022. The Company has filed extensive scientific information with the Environmental Court asking to lift a preliminary injunction which currently prevents further drilling. The Company is confident that drilling can resume with no significant risk to the environment as outlined in its granted environmental permits. If the injunction is lifted, drilling is expected to resume in Q3 2022.

Technical Details

All thicknesses from the drill hole intersections are down-hole drilled thicknesses. True widths will be estimated as the deposit model is updated, and information becomes available. * Copper Equivalent grade has been calculated using the following calculation: CuEq (%) = Cu (%) + 0.000333 x Mo (ppm) + 0.00826 x Ag (g/t), using the metal prices: 3.00 USD/lb Cu, 10.00 USD/lb Mo and 17.00 USD/oz Ag. No allowance for metallurgical recoveries has been considered. These are the same reference prices as in reporting of 2019 PEA. This means that the reported intercepts can be compared directly with the results published in the PEA. Approximate relative value on the PEA pricing is 93% copper, 6% molybdenum and 1% silver.

About Los Andes Copper Ltd.

Los Andes Copper Ltd. is an exploration and development company with an 100% interest in the Vizcachitas Project in Chile. Los Andes Copper Ltd. is listed on the TSX-V under the ticker: LA.

The Project is a copper-molybdenum porphyry deposit, located 120 kilometres north of Santiago, in an area of very good infrastructure. The Company’s Preliminary Economic Assessment (the “PEA”), delivered in June 2019, highlights that the Project has a post tax NPV of $ 2.7 billion and an IRR of 26.7%, based on a $3.50 per pound copper price.

Please refer to the technical report, compatible with NI 43-101, dated June 13, 2019, with an effective date of May 10, 2019 and titled “Preliminary Economic Assessment of the Vizcachitas Project”, prepared by Tetra Tech.

The PEA is preliminary in nature, it includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the PEA will be realized.

Qualified Person (“QP”) and Quality Control and Assurance

Antony Amberg CGeol FGS, the Company’s Chief Geologist, is the qualified person who has reviewed and approved the scientific and technical information contained in this news release. The QP has validated the data by, supervising the sample collection process, through chain of custody records and inspecting the detailed technical data and quality control and assurance information.

Los Andes Copper has a strict Quality Assurance and Quality Control (“QA QC”) protocol, which is consistent with industry best practices. There is a strict chain of custody from the project site to laboratory via the Company’s core cutting facility. The QA QC protocol includes the insertion of field duplicates, coarse duplicates, pulp duplicate, pulp and coarse blanks and Certified Reference Materials supplied by Ore Research and Exploration, Australia.

The core was analysed by ALS in Lima, Peru. All samples were assayed using the method ME-MS61, a four-acid digestion with an ICP-MS finish. Samples with grades above 0.7 % Cu were analysed using ALS method Cu-OG62, a four-acid digestion with an ICP-AES finish. The Company uses a program of detailed QA QC and monitors the performance of the laboratory.

For more information please contact:

R. Michael Jones, P.Eng CEO

rmj@losandescopper.com

+44 203 4407982

BlytheRay, Financial PR

Megan Ray

Rachael Brooks

Tel: +44 207 138 3203

E-Mail: info@losandescopper.com or visit our website at: www.losandescopper.com

Follow us on twitter @LosAndesCopper

Follow us on LinkedIn Los Andes Copper Ltd

Certain of the information and statements contained herein that are not historical facts, constitute “forward-looking information” within the meaning of the Securities Act (British Columbia), Securities Act (Ontario) and the Securities Act (Alberta) (“Forward-Looking Information”). Forward-Looking Information is often, but not always, identified by the use of words such as “seek”, “anticipate”, “believe”, “plan”, “estimate”, “expect” and “intend”; statements that an event or result is “due” on or “may”, “will”, “should”, “could”, or might” occur or be achieved; and, other similar expressions. More specifically, Forward-Looking Information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such Forward-Looking Information. Such Forward Looking Information includes, without limitation, the timing of and ability to obtain TSX-V and other regulatory approvals and the prospects, details related to and timing of the Vizcachitas Project. Such Forward-Looking Information is based upon the Company’s assumptions regarding global and Chilean economic, political and market conditions and the price of metals and energy and the Company’s production. Among the factors that have a direct bearing on the Company’s future results of operations and financial conditions are changes in project parameters as plans continue to be refined, a change in government policies, competition, currency fluctuations and restrictions and technological changes, among other things. Should one or more of any of the aforementioned risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from any conclusions, forecasts or projections described in the Forward-Looking Information. Accordingly, readers are advised not to place undue reliance on Forward-Looking Information. Except as required under applicable securities legislation, the Company undertakes no obligation to publicly update or revise Forward-Looking Information, whether as a result of new information, future events or otherwise.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

View Looking North of the PEA Resources + 0.5% Cu Eq and Position of Large or High-Grade Intercepts from 2022 Drilling indicating the deposit is open for potential expansion.